Adelaide’s housing market is the gift that keeps giving to homeowners – as the state is challenged by balancing positive demographic trends, Australia’s tightest city rental market (joint with Perth) and a chronic housing undersupply.

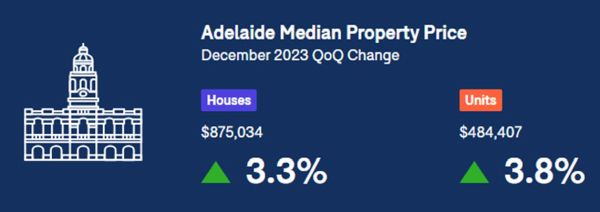

Although Adelaide is not traditionally seen as an investor market, the city has continued to defy expectations and demonstrate returns unlike any other in Australia. Despite house price growth losing momentum over the December quarter to rise roughly one-third slower than the previous quarter – rising by 3.3% – it remains well above the historical average growth of 2.6%. Despite this slowdown, keeping in line with the city’s ongoing trend, house prices rose to another record high. Previously stronger quarters of growth have pushed annual gains into double-digit growth once more, providing the fastest rise since September 2022.

Adelaide unit prices continued to grow over the December quarter at an eased pace one-third slower than the previous quarter. Adelaide is one of only three capital cities where unit prices are currently at an all-time high.

MARKET WRAP

Australia’s housing market has now fully recovered from the 2022 downturn – with combined capital house and unit prices ending 2023 at a new record.

This is the first time they have surpassed the previous records that were set in March 2022 for houses and December 2021 for units. It has been a steady recovery for house prices and a fairly speedy one for units relative to the downturn. House prices fell for three consecutive quarters and took four quarters of growth to recoup, while unit prices fell for five consecutive quarters and recovered in just three quarters of growth. The pace of gains over the past two quarters has been fairly consistent and has eased since the strong gains achieved earlier in the year. Annual gains are now at the steepest in 1.5 years for houses and two years for units.

House prices in Sydney and Brisbane are at record highs, ending 2023 fully recovered from the 2022 downturn. Adelaide and Perth also have record-high house prices, an outcome that has been a continual achievement for the cities in recent years. Unit prices in Canberra have also ended 2023 at a record high to mark their full recovery from the 2022 downturn. Brisbane and Adelaide also have record-high unit prices. In fact, they are the only cities to have peak pricing across houses and units. An established recovery is well underway for Sydney and Melbourne unit prices – Sydney is likely to hit a new record in the first quarter of 2024.

Perth, Brisbane and Adelaide recorded the largest house price gains over the December quarter, and only Canberra and Darwin saw a fall in prices over the quarter. For units, the gains were strongest in Hobart, Brisbane, Perth and Adelaide, with only Darwin declining over the quarter. The December quarter also consolidated the recovery for most capital cities, with Melbourne expected to complete its recovery during 2024. Weaker conditions are evident in our smaller capital cities: Canberra, Hobart and Darwin. Canberra was the only capital city to reach a new price trough at the end of 2023 and has the most to recover, along with Hobart and Darwin. The volatility being seen in Canberra is uncharacteristic of the city, which often competes with Melbourne for the title of second most expensive city.

Property prices continue to face headwinds from stretched affordability, undersupply of new homes, cost-to-build blowouts, additional investor levies (in Victoria), cost of living pressures and high interest rates. However, a growing population, unprecedented overseas migration and a tight rental market continue to boost housing demand. High interest rates will continue to exert stress on mortgage affordability and dampen housing demand, but housing demand is expected to lift if interest rates are cut in a timely manner. The choice of homes on the market has improved annually across the combined capitals. However, total properties for sale are still lower than last year and the five-year average, and only Melbourne, Canberra and Hobart have overall supply above the five-year average. Lower supply typically results in rapidly growing housing prices; however, growth is being contained due to the cost-of-living pressures and lack of mortgage affordability. Stage 3 tax cuts may alleviate some of the cost-of-living pressures and improve mortgage affordability — especially if the cash rate is also reduced sometime in 2024.